- The United States continues to offer a stable and predictable environment for business investment, consistently ranking among the countries with the fewest political and security risks for businesses and their workers.

- Scenarios such as armed conflict, civil disturbance, capital controls and expropriation all fall under the umbrella of “political and security risks” and all can be difficult to assess. Fortunately, various organizations and insurers provide tools to help gauge the relative risks across countries.

- Disaster preparedness is another related factor to consider – firms must assess such costs and the ability of its host economy to quickly and effectively respond to floods, earthquakes, and other natural disasters.

Political and security risks refer to political or criminal forces or events that can interfere with a business’ normal operations. Examples of political and security risks include expropriation, capital controls, breach of a government contract, and adverse regulatory changes, as well as war, terrorism, and civil disturbance. The impacts of these types of events can range from the temporary disruption of companies’ operations to the nationalization of company assets or, in a worst-case scenario, events that threaten employees’ physical safety.

These risks are hard to quantify and result in binary outcomes with unpredictable probabilities. It should be noted that in most cases, the probabilities are low. These events are not everyday occurrences within most of our trading partners. When they do happen, the federal government maintains programs to provide assistance to U.S. firms facing business problems abroad. Nor, unfortunately, are these events entirely impossible in the United States. Nevertheless, companies seeking to operate abroad or source from abroad should take into account, first, the fact that political and security risks do exist and, second, the relative likelihood that these events will occur; accordingly, they should dedicate resources to prepare for various contingencies.

Assessing and Evaluating Political & Security Risks

Some multilateral organizations and private firms, including insurers, publish information on global political and security risks, sometimes for free. The World Bank’s Multilateral Investment Guarantee Agency (MIGA), whose mandate is to promote foreign direct investment (FDI) in developing countries to enhance growth and development, produces an annual report on World Investment and Political Risk. This report examines general trends in the global economy and FDI, corporate perceptions of political risk, risk-mitigation strategies, and the latest developments in the Political Risk Insurance industry. This type of insurance is available for American companies with foreign operations from the Overseas Private Investment Corporation (OPIC), which is a U.S. government finance institution, as well as MIGA and the private sector. The Export-Import Bank of the United States also provides various insurance programs to mitigate country risks for American exporters.

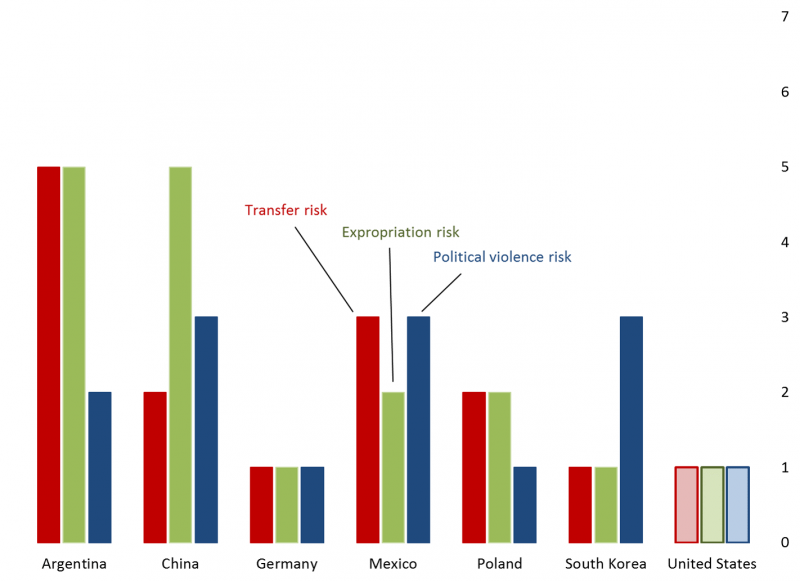

Another resource is the European credit insurance group Credendo. Its online country risks section shows country ratings on a risk scale of 1 (lowest) to 7 (highest) for risks associated with political violence, expropriation or government action, and transfer (essentially capital controls), all of which are relevant to firms looking to directly invest or set up operations abroad.[i] The chart below illustrates three Credendo risk ratings for several countries. Of the countries displayed, the United States and Germany pose the lowest risk in all three risk categories. Argentina presents the highest transfer risk, while Argentina and China are tied for the highest expropriation risk. China, Mexico and South Korea are all assessed to have a political violence risk of 3.

Political Risk Rating in Selected Countries

(1 to 7, with 7 being the highest risk)

Source: Economics and Statistics Administration analysis using data from ONDD.

Note: Transfer risk refers to the inability of private agents to transfer funds abroad due to government restrictions.

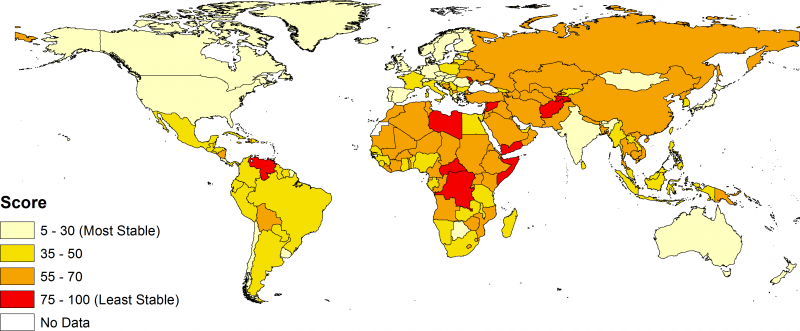

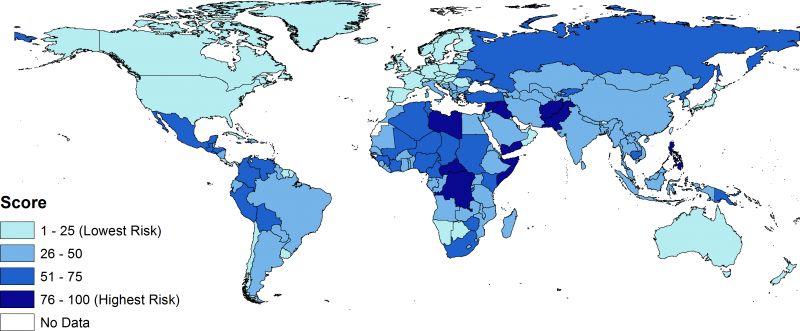

The Economist Intelligence Unit (EIU) defines political stability as “the degree to which political institutions are sufficiently stable to support the needs of businesses and investors.” The map below provides a cross-country comparison of political risk based on EIU data, highlighting the fact that the United States is one of the most politically stable countries. When reviewing these data, the data from Credendo, and other information on countries' political and security risks, it is important to note that each source defines and measures risk in its own way and not all risk areas may be relevant to all companies.

Political Stability Risk Score by Country, 2017

Source: Economics and Statistics Administration analysis using data from the Economist Intelligence Unit.

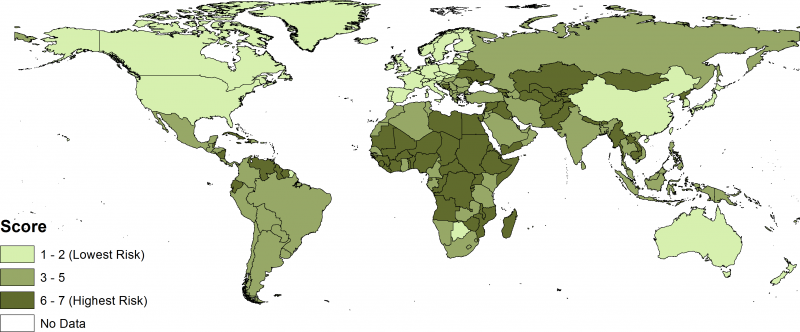

Transfer Risk

Transfer risk is the risk of a government imposing restrictions on the movement of funds out of a country by private agents; these essentially are capital controls. The map below indicates that some countries in Latin America, Eastern Europe, the Middle East and Africa present the highest transfer risk. Once again, the United States is among the countries with the lowest transfer risk scores.

Transfer Risk Score by Country, 2017

Source: Economics and Statistics Administration analysis using data from Credendo.

Risk of War and Crime

The physical safety of firms' employees is another consideration when doing business abroad, with war being the most extreme example of an event that places employees’ physical safety in jeopardy. While the war risk associated with most U.S. trading partners is low, general crime and safety risks are more commonplace and can vary notably both across and within countries. Direct costs can arise as companies adopt extra measures to protect executives, such as hiring private drivers or security services. Information on a particular country’s crime, safety and security concerns, sanitary issues, and general conditions can be obtained from the State Department's Consular Information Program. In addition, EIU estimates countries’ “security risk,” which is a joint assessment of war and crime risks that gauges the extent to which the “physical environment [is] sufficiently secure.”

The map below provides a comparison of security risk by country. It shows the United States is one of the countries with the lowest security risk.

Security Risk Score by Country, 2017

Source: Economics and Statistics Administration analysis using data from the Economist Intelligence Unit.

Disaster Risks

Natural disasters and epidemics are another set of events that American businesses need to consider when deciding where to locate operations or source their goods and services. Of course, as Hurricane Katrina in 2005, Japan’s earthquake/tsunami in 2010 and Superstorm Sandy in 2012 illustrate, natural disasters do not discriminate: they cause large-scale destruction and death in rich as well as poorer countries. At issue is not the probability of a natural disaster or epidemic, but whether the country possesses adequate resources, medical facilities, equipment and infrastructure to deal with these problems. Lack of preparedness and responsiveness, coupled with weak construction standards and environmental degradation in developing countries, can leave inhabitants and thus foreign businesses vulnerable following a natural disaster.

Conclusion

Doing business abroad may introduce risks due to political instability, expropriation or security. Companies should carefully consider these risks and any available avenues for mitigating them.

[i] These scores correspond to insurance premium categories for direct investments abroad.