- Inputs from a foreign supply chain may lead to lower product quality, potentially costly product returns and legal liability.

- Overseas supply chains reduce U.S. manufacturers' flexibility to quickly react to their customers' changing demands and requirements.

In the most basic sense, product quality means getting customers the product they want. At a minimum, a product of acceptable quality meets a set of previously agreed-upon specifications. However, quality can also be understood more broadly as the ability to quickly meet, if not anticipate, constantly changing market demand. In other words, it is no longer good enough for manufacturers to produce today a product that meets yesterday's specifications. Instead, firms must produce to meet today's real-time specifications and be able to turn on a dime in order to meet tomorrow's as well.

Meeting the Specs

There is anecdotal evidence of the role of product quality in U.S. manufacturers' decisions to reassess where they are producing or sourcing. The risk of product failure is real. Consider that 46 percent of respondents to a 2010 Accenture survey of North American manufacturing companies had "experienced product quality concerns as a result of offshored manufacturing and supply operations," and that 11 percent had product safety concerns. Increasingly, customers are asking for smaller, more frequent, more customized orders; transportation costs and commodity prices are rising; and exchange-rate pressures are increasing. In the same Accenture report, 61 percent of respondents indicated that they were considering shifting their manufacturing and supply bases closer to their customers to better meet demand.

Furthermore, according to a Booz & Company survey of 200 manufacturing executives, "only 5 percent [of respondents] viewed offshore plants as better in quality [than U.S. manufacturing facilities], and only 14 percent said that other countries' facilities would respond more effectively to volatile demand." Additionally, a 2014 Deloitte survey of over 150 public and private sector entities found that nearly 50 percent of offshoring companies cite poor service quality as a dissatisfying feature of their offshore vendors. (Other top-rated concerns were the reactive nature of their providers, lack of innovation and underqualified resources.)

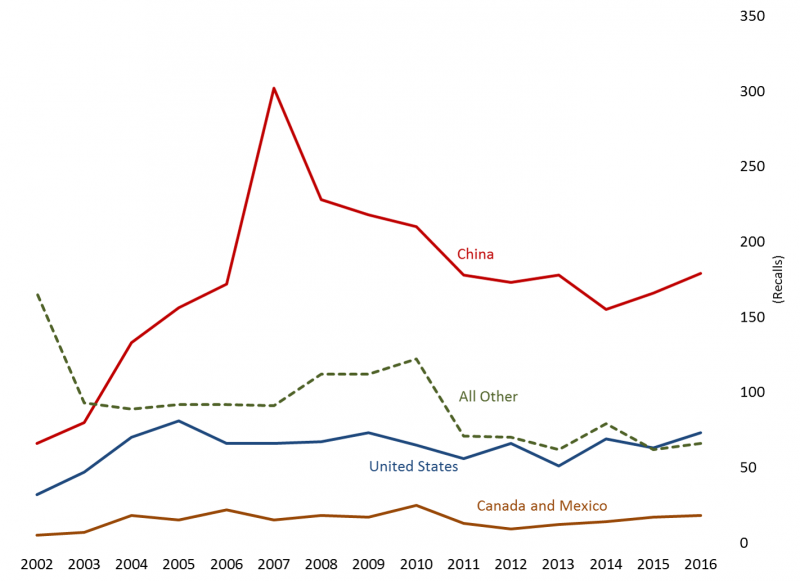

It is not easy to quantify the extent or cost of poor product quality of manufactured goods, let alone with respect to specific countries or geographic areas. Data from the Consumer Product Safety Commission (CPSC); however, does allow us to take a partial look at recalls by country. The CPSC publishes online a listing of recalls by country or administrative area of manufacture and year. These recall counts point to sizeable growth over the past decade in the recall notices of Chinese-made consumer goods from 58 in 2002 to 179 in 2016 (with a peak of 302 in 2007). This is not surprising given the sharp rise in goods imported from China. In contrast, there were 73 recall notices of U.S.-made consumer goods, 5 for consumer goods manufactured in Canada and 13 for goods from Mexico.[i]

Recalls Under Consumer Product Safety Commission Jurisdiction By Country or Administrative Area of Manufacture, 2002-2016

Source: Economics and Statistics Administration analysis using data from the Consumer Product Safety Commission.

Product Returns and Liability

Whether subject to a recall or not, defective products must be reworked in the United States or make a return trip to the manufacturer. This decision hinges upon various factors, including the relationship and trust between the importer and exporter, and the cost and time to ship the defective good back to the country of origin. These direct costs and risks come into play when considering the savings required to compensate for longer lead times required when sourcing from afar.

When product liability and litigation issues arise, offshore sources can make the issues even more complicated. As parties try to determine who is liable, two fundamental issues arise:

- In which jurisdiction will you pursue legal action?

- If you obtain a judgment against the foreign manufacturer, can and will it be enforced?

Contracts may cover these issues, but contracts are also subject to dispute and judicial review. Legal counsel ultimately would help firms answer these questions; however, the U.S. State Department notes that – given the absence of treaties or international conventions on reciprocal recognition and enforcement of U.S. judgments – the recognition and enforcement of U.S. judgments ultimately will be decided abroad.[ii]

Data from the World Bank's Doing Business initiative further highlight the difficulty of traversing different countries' legal systems and the considerable variation in regulatory compliance costs. These data capture the efficiency of contract enforcement by comparing the time, cost and quality of judicial processes involved in a sale of goods dispute, covering the full period from when the lawsuit is filed until payment is made. As the table below highlights, the 420-day estimate for the United States is below the average for each of the major regions, though the 30.5-percent average cost as a share of the claim is around average. U.S. judicial processes, however, are among the best in the world. Individual countries may have shorter times or lower costs, but – when compared to the other major regions below – the United States is competitive across all three measures.

| Time (days) |

Cost (% of claim) |

Quality of judicial processes (0-18) | |

|---|---|---|---|

| United States | 420 | 30.5% | 13.8 |

| East Asia & Pacific | 560 | 49.1% | 7.9 |

| Eastern Europe & Central Asia | 486 | 26.6% | 10.3 |

| Latin America & Caribbean | 749 | 31.3% | 8.4 |

| Middle East & North Africa | 653 | 25.0% | 5.8 |

| OECD High Income Countries | 553 | 21.3% | 11.0 |

| South Asia | 1,099 | 30.6% | 6.5 |

| Sub-Saharan Africa | 655 | 44.3% | 6.4 |

Source: Economics and Statistics Administration analysis using data from the World Bank, Doing Business project.

Flexibility

Meeting customers' specifications means providing them with what they wanted at the time they placed the order. Sourcing domestically can help firms gain the flexibility to allow them to react more quickly to customers' changing demands and requirements. A shorter distance between design operations, manufacturing facilities and customers facilitates "providing custom products, responding effectively to customer requests and ensuring delivery excellence in spite of demand swings," the hallmarks of high quality.

For larger companies, this thinking equates to a regional manufacturing strategy, and, for many, it is not new thinking. Honda Motors, which established the first Japanese auto assembly plant on U.S. soil in 1982, is an oft-cited example of a manufacturer that has long strived to locate manufacturing, research and development and sales centers near its customers. Similar sentiment underlies Airbus's decision to build a $600 million aircraft assembly plant in Alabama, as well as Whirlpool's 2013 decision to reshore production of front-load washing machines from Mexico to Ohio; both companies seek to bring production close to their key markets, not just in the United States but also overseas.

Still, the benefits of locating close to one's customers are relevant not just to major manufacturers but to all manufacturers. The earlier-cited Accenture survey found that product quality was the second most cited issue facing firms with offshore operations. The first issue was cycle or delivery time – in other words, the ability to respond to customers' needs.

A number of U.S. suppliers have regained business from U.S. clients who needed support quickly when offshored goods were of subpar quality. Consider the case of AmFor Electronics, Inc. in Portland, Oregon. This company has gained the capacity to go from a drawing to the production of the first article in just two weeks. As a result, it has gained new business from U.S. clients after being asked to step in and respond to errors in products from its offshore competitors.

Conclusion

Sourcing or producing in the United States may help reduce product quality risks and increase flexibility in responding to customer needs.

[i] Following the United States, the top recall counts in 2014 were from Taiwan (22), Mexico (9), India (9), and Canada (5).

[ii] According to the State Department, "[t]here is no bilateral treaty or multilateral international convention in force between the United States and any other country on reciprocal recognition and enforcement of judgments. Although there are many reasons for the absence of such agreements, a principal stumbling block appears to be the perception of many foreign states that U.S. money judgments are excessive according to their notions of liability. Moreover, foreign countries have objected to the extraterritorial jurisdiction asserted by courts in the United States. In consequence, absent a treaty, whether the courts of a foreign country would enforce a judgment issued by a court in the United States depends upon the internal laws of the foreign country and international comity. In many foreign countries, as in most jurisdictions in the United States, the recognition and enforcement of foreign judgments is governed by local domestic law and the principles of comity, reciprocity and res judicata (that is, that the issues in question have been decided already.)"